The Alliance has submitted the following comments in response to a Department of Energy Request for Information. We focused our comments on the questions posed in the Request for Information most relevant to solar PV manufacturing. Below we restate the relevant questions from the RFI followed by our perspective.

Area 2: Solar PV Technology

-

What are the current and future supply chain gaps and vulnerabilities as we scale up the adoption and use of solar PV technologies? Of these gaps and vulnerabilities, which are the most crucial for the U.S. to address and focus on and why?

-

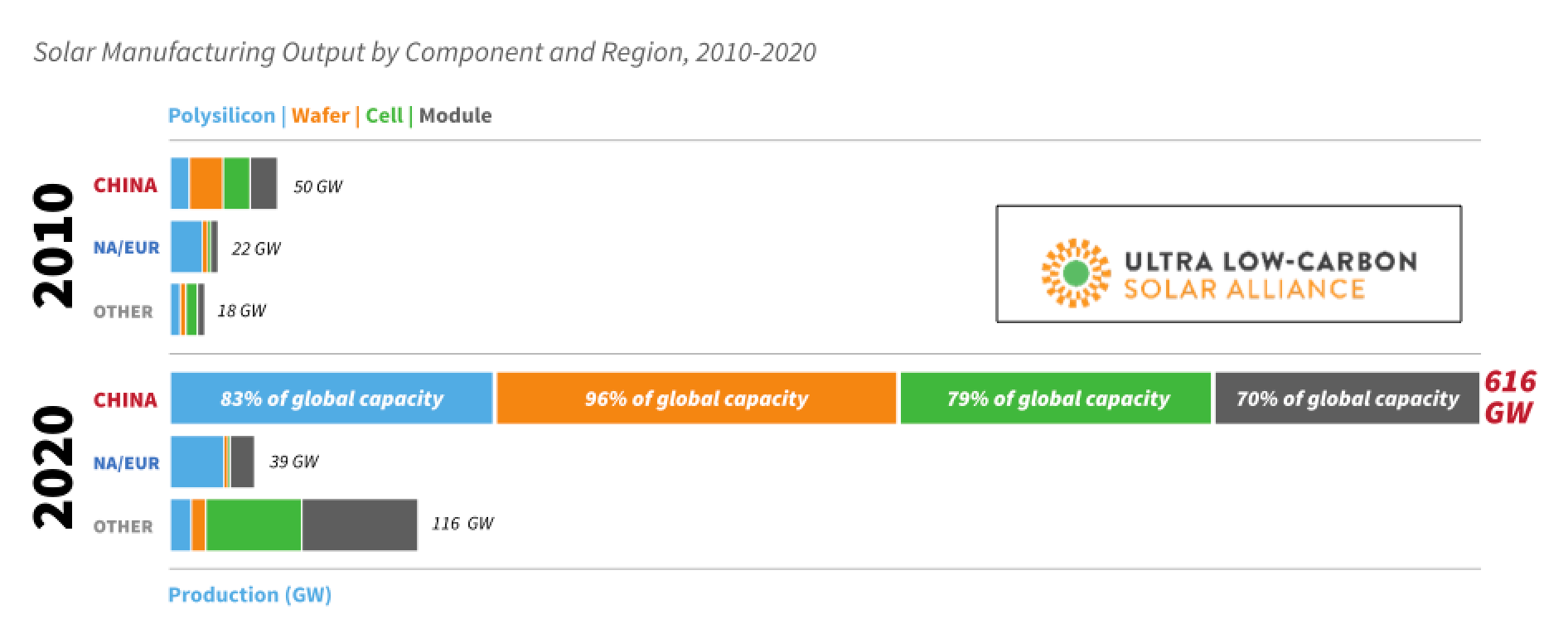

As regards vulnerabilities two factors stand out. The first is a profound overconcentration of solar manufacturing directly tied to and dependent upon the Chinese solar supply chain. Over 70% of manufacturing capacity at each step of the solar supply chain is concentrated in China, and that figure rises to 98% for critical steps like turning solar grade polysilicon into the wafers that provide the basis of solar cells. With the exception of two relatively small wafer companies in Norway, to get to market polysilicon has to pass through Chinese wafer plants, and with very high Chinese tariffs blocking entry of US polysilicon. This means little route to market for US polysilicon producers. As a result, there is significant unutilized US solar grade polysilicon capacity. This overconcentration also means that if for any reason the Chinese solar industry sneezes, the global supply of solar panels catches a cold.

We have seen this time after time. When multiple Chinese polysilicon producers had major explosions and fires that shut plants down in 2020 and 2021 the global price of polysilicon skyrocketed and supply was curtailed. When covid began to disrupt work forces in factories and ports and supply-demand imbalances drove shipping prices higher US solar customers began to struggle to get adequate supplies of solar panels. These latter challenges continue to threaten solar deployment goals.

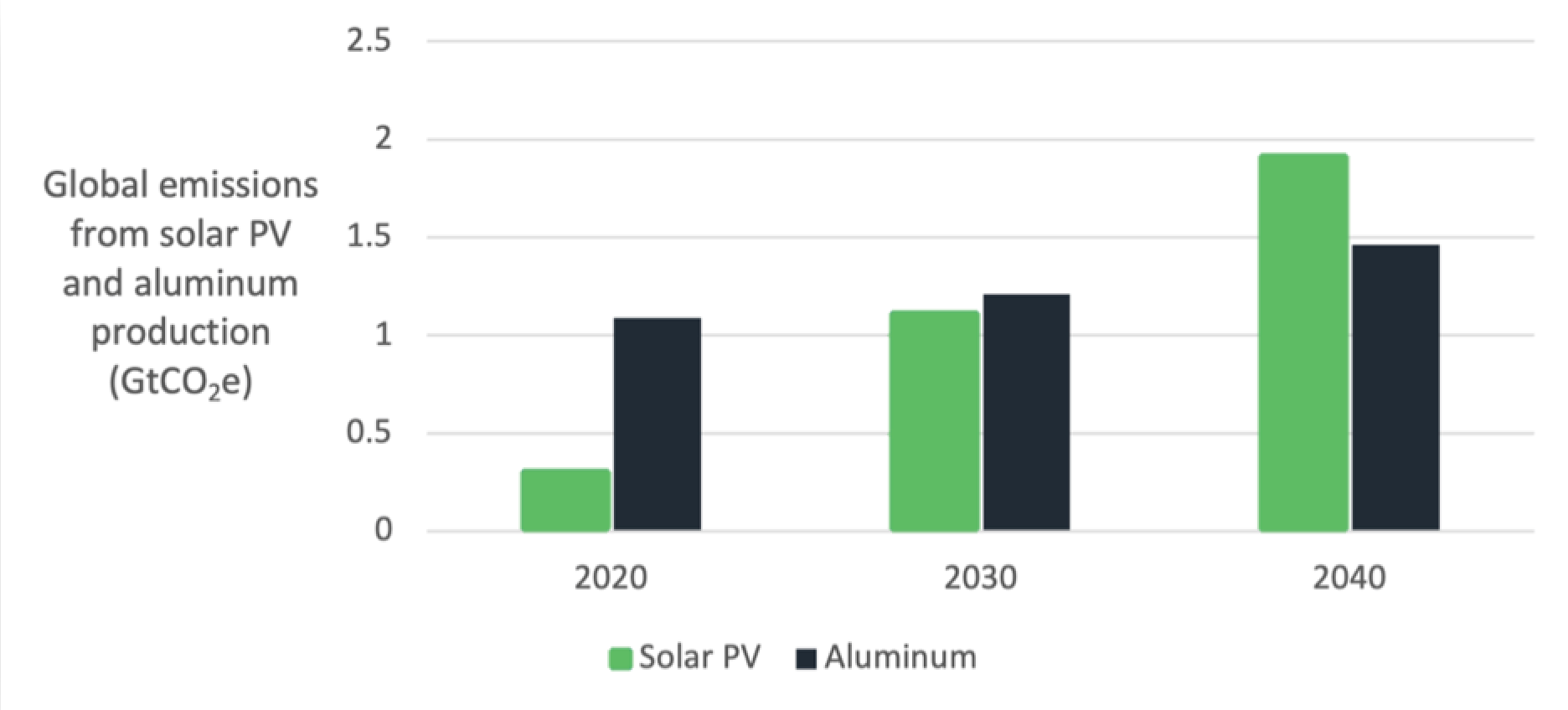

The other major factor is significant sustainability concerns with this highly concentrated solar supply chain. The Chinese electricity grid is roughly 40% more carbon intensive than the US grid and much of the most energy intensive manufacturing in the Chinese supply chain, polysilicon, is located in Xinjiang Province and Inner Mongolia where the plants are powered with coal-fired electricity. This power is also heavily subsidized such that there is relatively low motivation to invest in industrial energy efficiency as compared to the US where energy costs are a more substantial component of production costs. The end result is that solar modules from the Chinese solar supply chain have roughly twice the embodied manufacturing supply chain carbon emissions (often referred to as embodied carbon or carbon footprint) as those arising from the US and EU solar supply chains. The Clean Energy Buyers Alliance has estimated that if projected solar demand is served primarily by growth in Chinese solar manufacturing it would result in a cumulative 14-18 billion tons of additional carbon emissions by 2040. In addition, there is substantial evidence of the use of forced labor in the solar industry in Xinjiang, and this polysilicon is widely used in Chinese wafer plants and is therefore widelv present in Chinese solar panels.

These concerns are giving rise to both policy responses and private sector efforts to avoid products tainted with these practices. These factors suggest that if growth in solar manufacturing continues to occur primarily in China sustainability and supply challenges will only grow.

Projection by the Clean Energy Buyers Alliance of Carbon Emissions Growth if Solar Supply Chain Remains Concentrated In China

-

-

Where in the solar PV supply chain does it make sense for the U.S. to focus and prioritize its efforts both in the short-term and the long-term, and why? Where in the supply chain do you see opportunities for the U.S. to build durable domestic capabilities of solar PV manufacturing? For areas in the supply chain where U.S. opportunities to build domestic manufacturing capabilities are limited, which foreign countries or regions should the U.S. government prioritize for engagement to strengthen/build reliable partnerships, and what actions should the government take to help ensure resilience in these areas of the supply chain?

-

The US should focus on the core manufacturing steps in the solar supply chain; solar grade polysilicon production, solar wafer production, solar cell production and module production. As a matter of priority, the US should focus particular attention initially on polysilicon, wafer and cell manufacturing There is unutilized polysilicon capacity in the US that domestic wafer manufacturing would unlock. These polysilicon companies are also able to scale up their base level of production to meet rapidly growing demand for solar if they have an outlet for their material. In response to the sustainabilitv concerns discussed above buyers are seeking different supply options and solar module manufacturing is already expanding in the US. Closing the current gap in the US supply chain of wafer and cell as the first priority would accelerate the creation of an end-to-end US supply chain. Other components of solar manufacturing such as inverters, framing, glass, backsheet, etc. are generally less capital intensive and an expanded domestic market for those goods would help induce expansion. Policy support may be appropriate as well. The Solar Manufacturing for America Act (SEMA), which provides varying production tax credits at each step in this supply chain, combined with a strong demand signal for more sustainable solar such as preferred federal purchasing of sustainable solar ecolabel would be powerful policy signals for rapid expansion of domestic solar manufacturing. As we will discuss in more detail later in these comments Type I third party validated ecolabels like the EPEAT PV ecolabel can facilitate such purchasing.

The domestic solar grade polysilicon manufacturers also produce semiconductor grade polysilicon. Because of the significant investments made to construct their solar grade production assets these companies need their solar businesses to remain profitable in order for their enterprises to be profitable. This means that to ensure a secure domestic supply of semiconductor grade polysilicon it is important that these companies can fully utilize their solar grade polysilicon capacity to keep their balance sheets healthy. As economy of scale is important to competitive economics in solar manufacturing, policies like SEMA that would help the polysilicon producers scale up production capacity are an important element of building a resilient, sustainable solar supply chain. An expanded supply of domestic solar grade polysilicon would also provide the necessary raw material and rationale for an expanded US wafer and cell industry.

It is also important to note that polysilicon and wafer manufacturing are the two most energy intensive steps in the solar supply chain. Because the US power grid is much cleaner than China's, expanding production of those goods in the US would result in significantly lower carbon emissions than if that production were located in China.

The US and EU solar supply chains are already well integrated, and we should seek opportunities to deepen that integration to take advantage of the capacities ands strengths of both economies. There is significant solar manufacturing capacity in allied nations in SE Asia, as well, much of it with access to low carbon hydro power-rich grids. This should be considered in the development of a more globally diverse, resilient and sustainable solar supply chain. India is also making significant policy investments to develop an end-to-end solar supply chain, with both US and EU based solar manufacturers participating. Projected global solar demand is such that the US should be seeking collaboration with our allies to rapidly scale up sustainable solar manufacturing - there is plenty of solar market to go around.

-

-

What challenges limit the U.S.'s ability to realize opportunities to build domestic solar PV manufacturing? What conditions are needed to help incentivize companies involved in the solar PV supply chains to build and expand domestic manufacturing capabilities?

-

The solar market has become verv cost driven, even as solar prices have tumbled over the past decade. As such, US manufacturers are forced to compete with "the China price", despite the fact that these prices are in many ways artificial (extensive government market intervention and noneconomic subsidization, significant externalities not reflected in selling price). While US manufacturers have dramatically remade their businesses to compete in this environment, with increasing manufacturing scale and automation, some cost elements of manufacturing in the US can make it challenging to compete with this "China price". To compete in this environment solar manufacturers need to reach significant production scale to get per-unit economics competitive. Policies that incent and support rapid scale up therefore can play a role in support of expansion of the domestic solar supply chain. A production tax credit like SEMA that would help manufacturers rapidly scale to multi-gigawatt scale would help to rapidly ease this challenge. The expanded DOE loan guarantee program and the 48C Advanced Manufacturing Tax Credit can also assist some companies in financing these investments.

Pricing the significant externalities in the Chinese industry in some fashion would also serve to change the competitive calculus. Policies that put products on a more market-based competitive footing, such as carbon-cognizant trade policies, can help to address these distortions.

As solar is increasingly integrated into new and existing buildings incorporating solar into "Buy Clean" legislation and procurement regulations would provide further market pull and incentivize companies involved in the solar PV supply chains to build and expand domestic manufacturing capabilities. An effective "Buy Clean" program would set targets for embodied carbon in building materials, including solar, used in projects that receive public funding. The EPEAT PV ecolabel described below can serve as the embodied carbon standard for photovoltaic solar in such programs.

There has also been little market recognition of the sustainability and supply risks associated with the Chinese solar supply chain, which has limited the demand for better solar. Fortunately, that is changing, and we are beginning to see market interest in low carbon solar. A sustained market demand for more sustainably produced low carbon solar would clearly signal manufacturers to expand their operations in lower carbon economies. As regards federal preferred purchasing of sustainable low carbon solar, we have already described how the US solar supply chain, by dint of a cleaner grid and more efficient manufacturing, produces solar modules with markedly lower levels of embodied supply chain emissions than Chinese solar producers. Thus, entities that preferentially buy low carbon solar will be preferentially buying solar modules with domestic content and thereby supporting scale up of sustainable solar production to meet the demand for low carbon solar. To facilitate this virtuous circle the Global Electronics Council (GEC) is amending their existing Type I PEAT PV ecolabel with embodied carbon criteria derived from existing French and South Korean regulatory programs, a European Solar Environmental Product Declaration and the input of a multinational multi-stakeholder body in a voluntary, consensus-based process. The updated ecolabel will become available this year to facilitate specification and purchasing of low carbon solar modules with domestic content. PEAT is already recognized in the Federal Acquisition Regulations and both DOE and EPA are participating in the development of the embodied carbon criteria. EPEAT also serves as a demonstration of compliance with the EU's Green Public Procurement requirements.

There are several benefits of using government procurement preferences for low carbon solar based on EPEAT:

- It would drive improved performance in reducing greenhouse gas emissions from solar deployment. Federal purchasing of low carbon solar would also motivate expanded solar manufacturing in the low carbon economies of the United States and the European Union to satisfy this market demand for lower carbon solar supply.

- The U.S. and EU solar manufacturing sectors are already well integrated, and significant opportunities for further business collaborations exist in expanding solar manufacturing. A procurement preference for low carbon solar in both iurisdictions would be mutuallv beneficial and promote joint solar supply chain resilience.

- Because the standard has transparent criteria based on health and environmental grounds, it would apply regardless of product origin. Thus, a procurement preference based on the standard would be consistent with international trade obligations. In this regard we applaud the recent Executive Order encouraging the use of Federal purchasing to catalyze the domestic clean energy sector.

-

-

How can government (federal, state, local, and Tribal) help the private sector and communities involved in solar PV manufacturing build and expand domestic solar PV manufacturing in the U.S.? What investment and policy actions are needed to support domestic manufacturing of solar PV?

-

Both SEMA and federal (and state) purchasing are constructive policies to motivate scale up in domestic solar manufacturing across the supply chain. In some manner encouraging the use of sustainably manufactured solar panels in the context of policies like the existing solar investment tax credit would also provide a sustained demand signal that would help to de-risk domestic manufacturing investments.

In addition, timely permitting of new or expanded facilities at all levels of government can be a significant boost to manufacturing investment. It can take substantial time periods to receive the myriad permits a large manufacturing facility requires, time during which a company is making capital investments but not able to produce and sell product. Better coordinating permit requirements and reducing this time, allowing companies to realize revenues more quickly, can be helpful.

Given the existing integration between the US and EU solar supply chains, the US/EU collaboration in the development of embodied carbon criteria for inclusion in the EPEAT PV ecolabel and the current recognition of EPEAT in both jurisdictions, it is appropriate for the US and EU to make EPEAT PV and embodied carbon in solar an element of the work of the Trade and Technology Council.

-

-

What specific skills are needed for the workforce to support the solar PV manufacturing supply chain? Of those skills, which ones are lacking in current education/training programs? What resources (including time) and structures would be needed to train the solar PV workforce? What worker groups, secondary education facilities, and other stakeholders could be valuable partners in these training activities? What new education programs should be included (developed?) to prepare the workforce?

- One of the benefits of expanded domestic solar manufacturing and deployment is the range of additional jobs created, spanning manufacturing, advanced robotics and IT, engineering, sales, marketing, construction and maintenance. Many of the positions that would be created would be expected to be compatible with the engineering and mechanical skills of workers from other parts of the energy sector including mining and oil and gas.

-

What other input should the federal government be aware of to support a resilient supply chain of this technology?

- The US, like most nations, has dramatically expanding solar deployment as a keystone element of its climate goals. The overconcentration and unsustainable practices in the Chinese solar supply chain are already leading to supply challenges, challenges that will only grow if the supply chain remains so highly concentrated. In addition, solar is now the fastest growing form of energy in the US and the business sector will be increasingly reliant upon it for growth powered by industrial electrification and creating an electrical vehicle fleet. Given that China is a strategic competitor this exposure creates significant potential risks. Therefore, the US should consider making the creation of a more diversified, resilient and sustainable solar supply chain a strategic priority.